Specialist Advice: Bagley Risk Management Techniques

Specialist Advice: Bagley Risk Management Techniques

Blog Article

Comprehending Livestock Danger Security (LRP) Insurance Coverage: A Comprehensive Overview

Browsing the realm of animals threat security (LRP) insurance policy can be a complicated venture for many in the agricultural market. This kind of insurance policy supplies a safeguard versus market fluctuations and unforeseen scenarios that might influence livestock manufacturers. By recognizing the complexities of LRP insurance policy, manufacturers can make enlightened decisions that may protect their procedures from financial threats. From exactly how LRP insurance policy operates to the different insurance coverage alternatives offered, there is much to reveal in this comprehensive guide that might possibly form the way livestock producers approach risk administration in their companies.

Exactly How LRP Insurance Coverage Functions

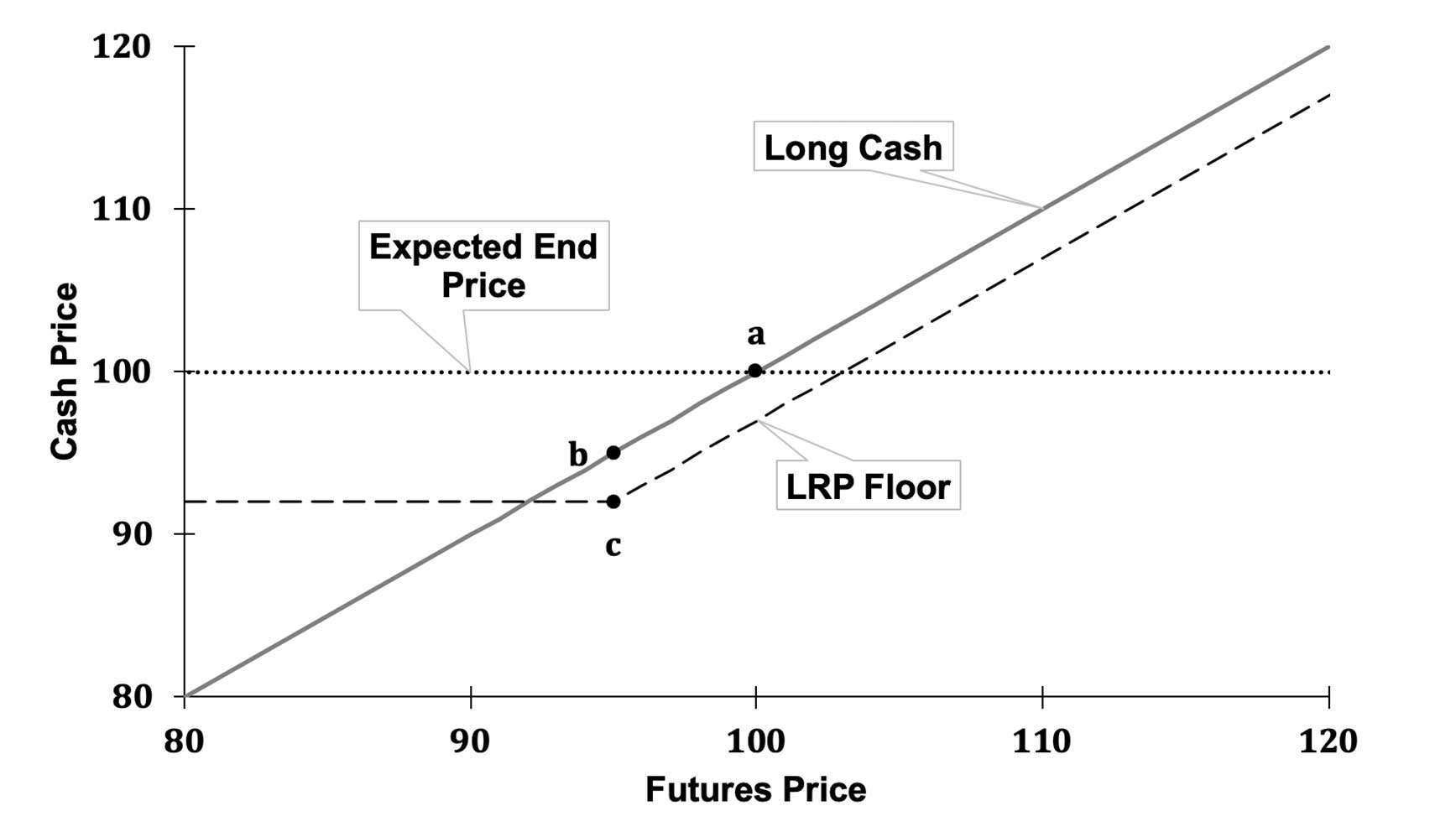

Occasionally, comprehending the auto mechanics of Animals Risk Security (LRP) insurance policy can be complicated, however breaking down how it functions can supply clarity for breeders and farmers. LRP insurance coverage is a threat administration device made to secure animals producers against unforeseen cost decreases. The plan permits producers to establish an insurance coverage degree based on their certain needs, choosing the variety of head, weight range, and coverage rate. As soon as the policy is in place, if market value drop listed below the coverage rate, producers can sue for the distinction. It is necessary to keep in mind that LRP insurance coverage is not a revenue guarantee; rather, it focuses solely on cost risk security. The insurance coverage period commonly ranges from 13 to 52 weeks, supplying flexibility for manufacturers to pick a duration that lines up with their manufacturing cycle. By utilizing LRP insurance policy, breeders and farmers can alleviate the economic risks related to varying market value, making certain greater stability in their procedures.

Eligibility and Coverage Options

When it concerns insurance coverage choices, LRP insurance policy provides manufacturers the flexibility to pick the coverage level, insurance coverage duration, and endorsements that finest match their risk administration demands. Protection degrees generally vary from 70% to 100% of the expected finishing value of the insured livestock. Manufacturers can likewise pick coverage durations that line up with their production cycle, whether they are insuring feeder livestock, fed cattle, swine, or lamb. Endorsements such as price danger defense can further customize protection to secure versus adverse market changes. By recognizing the eligibility criteria and insurance coverage alternatives readily available, animals manufacturers can make enlightened choices to take care of risk successfully.

Advantages And Disadvantages of LRP Insurance Policy

When reviewing Animals Threat Defense (LRP) insurance policy, it is important for animals manufacturers to consider the advantages and negative aspects integral in this danger administration tool.

Among the primary benefits of LRP insurance is its capacity to provide security versus a decrease in livestock costs. This can aid protect manufacturers from financial losses resulting from market variations. Additionally, LRP insurance policy provides a degree of versatility, enabling manufacturers to customize insurance coverage levels and policy periods to fit their specific demands. By securing a guaranteed price for their animals, producers can much better take care of threat and plan for the future.

However, there are likewise some disadvantages to think about. One restriction of LRP insurance coverage is that it does not secure versus all kinds of dangers, such as illness break outs or all-natural catastrophes. Furthermore, costs can in some cases be pricey, specifically for producers with huge animals herds. It is important for manufacturers to thoroughly examine their private risk exposure and financial scenario to establish if LRP insurance policy is the appropriate danger management device for their procedure.

Understanding LRP Insurance Policy Premiums

Tips for Taking Full Advantage Of LRP Conveniences

Making the most of the advantages of Animals Risk Security (LRP) insurance policy requires calculated preparation and proactive risk administration - Bagley Risk Management. To take advantage of your LRP insurance coverage, think about the following tips:

Regularly Examine Market Conditions: Keep informed regarding market fads and price fluctuations in the animals market. By checking these elements, you can make educated decisions regarding when to buy LRP protection to secure versus prospective losses.

Establish Realistic Protection Degrees: When choosing insurance coverage levels, consider your manufacturing costs, market worth of animals, and prospective threats - Bagley Risk Management. Setting reasonable protection levels guarantees my company that you are adequately protected without paying too much for unneeded insurance coverage

Expand Your Coverage: Rather than relying entirely on LRP insurance coverage, think about diversifying your risk monitoring approaches. Combining LRP with other threat monitoring tools such as futures contracts or alternatives can give thorough insurance coverage against market uncertainties.

Testimonial and Readjust Protection Regularly: As market problems transform, occasionally examine your LRP protection to ensure it straightens with your present danger exposure. Adjusting coverage levels and timing of purchases can assist maximize your threat protection approach. By following these tips, you can take full advantage of the advantages visit this web-site of LRP insurance policy and safeguard your animals operation against unanticipated threats.

Verdict

Finally, livestock danger defense (LRP) insurance coverage is a valuable tool for farmers to take care of the monetary threats associated with their animals operations. By understanding just how LRP works, qualification and coverage choices, along with the advantages and disadvantages of this insurance, farmers can make educated choices to shield their source of incomes. By thoroughly taking into consideration LRP premiums and carrying out approaches to make best use of benefits, farmers can reduce prospective losses and make certain the sustainability of their operations.

Animals producers interested in acquiring Animals Risk Defense (LRP) insurance coverage can check out an array of qualification criteria and protection choices customized to their details livestock operations.When it comes to protection alternatives, LRP insurance policy provides producers the versatility to pick the coverage degree, coverage duration, and endorsements that ideal match their threat administration demands.To understand the details of Livestock Danger Security (LRP) insurance fully, understanding the factors influencing LRP insurance coverage premiums is important. LRP insurance costs are determined by various aspects, consisting of the protection level chosen, the anticipated cost of livestock at the end of the coverage duration, the type of animals being insured, and the length advice of the coverage period.Review and Adjust Coverage Frequently: As market conditions alter, regularly assess your LRP protection to guarantee it lines up with your existing threat exposure.

Report this page